Introduction

If you are the new face of the entrepreneur in India and want to start your business then what are you waiting for? This means that you can be pleasantly surprised to know that the government provides a range of financial assistance programs in the form of subsidies for entrepreneurs in India.

Apart from reducing costs, such subsidy can also be a catalyst for newly ventured, the much-needed capital being used in overcoming the myriad of expenses that accompany setting up and managing a business. In this article, you will understand the different kinds of Indian entrepreneurs, from the best Credit subsidies to the acquisition of technology, standards of quality, and more.

Table of Contents

Subsidy

The government of India provides financial support to new or upcoming entrepreneurs, which is called a subsidy. The reason behind providing subsidies is to encourage the investment of new entrepreneurs which helps the economic growth of the country. Subsidy supports entrepreneurs to expand and grow their businesses and turns to provide services to the countrylike increasing employment, providing goods to the market, etc.

There are different types of inputs required to start a company like raw materials, land, machinery, management, capital, etc. The government therefore provides subsidies in the aforementioned criteria so that the entrepreneurs can use them to set up their new businesses.

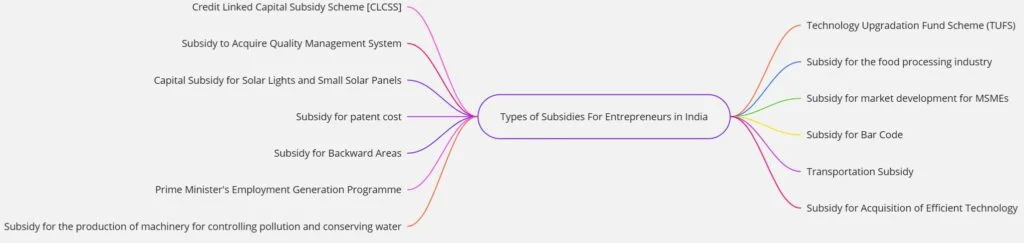

Types of Subsidies For Entrepreneurs in India

Following are the different types of subsidies available to entrepreneurs in India:

1. Credit Linked Capital Subsidy Scheme [CLCSS]

![1. Credit Linked Capital Subsidy Scheme [CLCSS]](https://entrepreneurdost.in/wp-content/uploads/2024/04/Credit-Linked-Capital-Subsidy-Scheme-CLCSS-1024x563.jpg.webp)

A lot of the Small Scale Industries (SSI) in India still use old technology and equipment to make their products due to the lack of awareness about access to capital, quality standards, and modern technology. So the grants are helping to improve the technology facilities and upgradation of SSI in India, the Ministry of Small Scale Industries has a program to upgrade technology. This scheme is called the Credit Linked Capital Subsidy Scheme. The Credit Linked Capital Subsidy Scheme (CLCSS) provides a 15% capital subsidy to SSI units that take institutional finance to bring in advanced technology in various approved sub-sectors/products. This subsidy is available for loans up to 1 crore.

2. Subsidy to Acquire Quality Management System

Due to the increasing global market, MSME units need to compete in quality standards to stay market. To support this, the government offers to encourage the same, subsidy Indian MSME units to adopt quality standards and cover expenses of obtaining ISO certificates like ISO 9000 and ISO 14001. This program offers a refund for the costs of obtaining ISO-9000/ISO-14001 certifications to all small-scale industries. They can receive up to 75% of their expenses, with a maximum limit of 75,000.

3. Capital Subsidy for Solar Lights and Small Solar Panels

The Indian Govt has introduced the Jawaharlal Nehru National Solar Mission (JNNSM) to promote the production of sustainable energy and increasing demand for energy in India while addressing India’s energy security challenge. The JNNSM offers a variety of subsidies and soft loans for the promotion and boost of solar energy generation in the nation.

In the capital subsidy for solar lighting and small-capacity PV systems, the JNNSM offers a capital subsidy of up to 40% of the approved unit cost (benchmark cost) for solar lighting systems and small-capacity photovoltaic systems. Capital subsidy of 90% of the benchmark cost will receive special category states like the North East, Sikkim, J&K, Himachal Pradesh, and Uttarakhand

4. Subsidy for patent cost

The IT department, MCIT, and the Government started a scheme to offer subsidies to various medium-sized enterprises (SME) and technology start-ups looking for international patents the main aim of this subsidy is to boost their creativity and seize chances for growth opportunities in the field of information technology. The scheme also provides for a subsidy of 50% of the patent cost incurred by the industry, encouraging them to protect their inventions through patents.

5. Technology Upgradation Fund Scheme (TUFS)

The Textiles Sector is the 2nd major source of employment after agriculture. It plays an important role in industrial production, contributing about 14%. It also contributes 4% to the GDP, and 17% to the country’s export earnings. It provides jobs to over 35 million people, which includes a considerable number of SC/ST and women.

For further support, the Ministry of Textiles introduced the Technology Upgradation Fund Scheme(TUFS).

The TUFS Scheme offers a 5% interest charged by financial institutions or banks for textile technology upgrade projects. Moreover, this scheme also offers margin money and/or capital subsidies for investing in various types of textile manufacturing equipment. These include power looms, common effluent treatment plants, garment machinery, machinery for technical textiles, handlooms, and more.

6. Subsidy for the food processing industry

For establishing, upgrading, and modernization of the food processing industry, assistance in the form of grants up to 25% of P & M and technical civil work subjects. The Government of India provides 50 lakhs in general area and 33% subject to a maximum of 75 lakhs in difficult areas. This program gives financial support to small and medium-sized manufacturing businesses to take part in international trade fairs and exhibitions through the MSMEs India stall.

7. Subsidy for market development for MSMEs

This scheme offers financial support for manufacturing SMEs in international trade fairs and exhibitions at the MSMEs India booth. The Indian Government is offering to cover 75% of airfare and 50% of rental costs for MSME manufacturing enterprises. For women and SC/ST entrepreneurs, the Government will reimburse 100% of space rent and airfare.

8. Subsidy for Bar Code

To enhance the competitiveness of MSMEs, a subsidy of up to 75% and an annual registration fee for getting a barcode fa or recurring fee for 3 years is provided under this scheme.

9. Subsidy for Backward Areas

A subsidy of 15% of investment in Plant & Machinery is provided to units set up in backward areas.

10. Transportation Subsidy

To promote industries in areas not accessible and hill areas, 50% to 90% of investment in plant and machinery is provided as a subsidy.

11. Prime Minister’s Employment Generation Programme

Under this program, urban and rural entrepreneurs in the general category can avail themselves of 15% and 25% subsidies respectively on project costs. In the case of a weaker section of society, a 25% and 35% subsidy is provided to urban and rural entrepreneurs respectively.

The Government of India has proposed an expenditure of 5,060 crores for this program during the 12th Plan.

12. Subsidy for Acquisition of Efficient Technology

The Indian Govt has launched the Technology Acquisition and Development Fund as part of the National Manufacturing Policy. The scheme provides direct support for technology acquisition Reimbursement of 50% of the technology transfer fee or 50 lakhs whichever is lower is granted to individual industries.

13. Subsidy for the production of machinery for controlling pollution and conserving water

The subsidies mentioned above also provide support for the production of machinery, equipment, and gadgets that help control pollution, decrease energy usage, and conserve water. The manufacturing unit will be provided with a subsidy of 10% of capital expenditure incurred on new plant and machinery subject to a maximum of 50 lakhs.

Conclusion

As you can see, the Indian administration provides a broad range of Grants For Entrepreneurs in India to allow for the setting up and survival of the businesses. These subsidies are an excellent bridge to help hard money-starved young entrepreneurs complete their business projects and fulfill their ambitions.

One of the key enlightenments of these programs is that they help entrepreneurs to obtain considerable financial gain and to raise their opportunities for success. Remember that, if you are an entrepreneur in India, conduct detailed research about the different subsidy programs available to you and check if you can receive the benefits. Just with the proper assistance your business concept can get turned into a real one.

Pingback: Various Causes of Industrial Sickness