Planning to launch your own venture and wondering how to start a small business in India in 2026? There’s never been a better time. India’s MSME sector is expanding rapidly, with strong government support aimed at making entrepreneurship easier, more profitable, and accessible to everyone.

In 2026, policies from the Union Budget, new funding schemes, and digital initiatives make business registration and access to credit smoother than ever. Government schemes like Pradhan Mantri Mudra Yojana, PMEGP, and enhanced MSME benefits are fueling business growth in high-potential sectors like online services, sustainable goods, and logistics. With more than 5.9 crore MSMEs already operating and contributing nearly half of the country’s exports, the environment is primed for new ideas.

This guide covers every step for starting up: from researching the right idea and choosing a business structure to finalizing registrations, securing funds, and building your market presence. Whether you want to create a one-person operation or launch a company with big plans, you’ll find clear, practical steps to turn your idea into a registered and running business in 2026.

If you’re interested in building a business in fast-growing fields, you may also want to check this guide on how to start a gaming company in 2025 for inspiration.

For more high-income business ideas and trends for 2025–26, watch this video:

Ready to take the first step? Let’s get started.

Research and Planning Your Business

A good business starts with smart research and thoughtful planning. Before you invest your time or money, you need to be sure your idea makes sense and can grow. Strong planning will help you avoid mistakes, save resources, and find early wins. Let’s break down the research and planning process into clear steps.

Identify Profitable Business Ideas

Every success story in business begins with an idea that solves a real problem or fills a demand in the market. To find your own, look at daily challenges, talk to people, and stay alert to new trends. The goal is to pick a business idea that matches your own interests and skills while standing out in the market.

Popular niches for 2026 include:

- Online education and e-learning platforms: The demand for digital learning keeps rising. Offer specialized courses, skill-based training, or tutoring.

- Cloud kitchens and food delivery brands: More consumers now want fast, high-quality delivery from brands that don’t require a storefront.

- Eco-friendly and sustainable products: Products made from recycled materials, green packaging, and conscious manufacturing have strong appeal.

- Healthcare services at home: With India’s aging population, in-home care and digital health services are growing fast.

- Remote work tools and services: Support businesses and professionals shifting to online, location-free work environments.

How to check if your idea is a good fit? Use free online tools like Google Trends, Keyword Planner, and forums to validate demand. Check out lists such as the 80 top small business ideas in India for 2025 for more inspiration.

Conduct Market Research

Effective research helps you understand if people will buy your product, how much competition exists, and what makes your offer unique. You want to prove there’s enough demand in your market before you move forward.

Here’s a simple step-by-step approach:

- Define your target customer: Age, income, location, habits, pain points.

- Analyze the competition: Study their websites, prices, customer feedback, and marketing. What are they doing well? Where do they fall short?

- Assess demand: Use surveys, polls, and one-on-one interviews to get feedback directly. Social media platforms like Instagram and Facebook are great for listening to conversations and trends.

- Check growth data: Use government reports, local business chambers, and news sites to track sector trends.

For a deeper dive into demand analysis and practical methods, look at this resource on market and demand analysis for startups.

Write a Simple Business Plan

A good business plan does not need to be long. You can keep it to five pages, clear and direct. It acts as your reference and makes it easier to get help from banks or investors.

Here are the must-have sections:

- Business overview: Short description of your business idea, what you sell, and your vision.

- Target market: Who will buy your product or service? Be specific.

- Revenue model: How will you make money? (direct sales, subscriptions, ads, etc.)

- Cost structure: What are your fixed and variable costs? Include rent, salaries, marketing, raw materials.

- Financial projections: Estimate sales, costs, and profits for the next 1–3 years.

Templates are easy to find and fill out. Focus on making it simple but realistic. Tools and tips on how to draft a plan can be found in many guides—a solid place to start is the article on 55+ small business ideas and planning steps.

A well-evaluated idea, real data from your market research, and a direct business plan will give you the confidence to move to the next important step in how to start a small business in India in 2026. Good groundwork protects your investment and gets you ready to launch.

Choose the Right Legal Structure

Choosing the right legal structure is one of the most important steps when you learn how to start a small business in India in 2026. Your decision will affect taxes, ownership, fundraising options, compliance, and even your personal liability. Take your time on this, as the right foundation will set you up for steady growth and easier management.

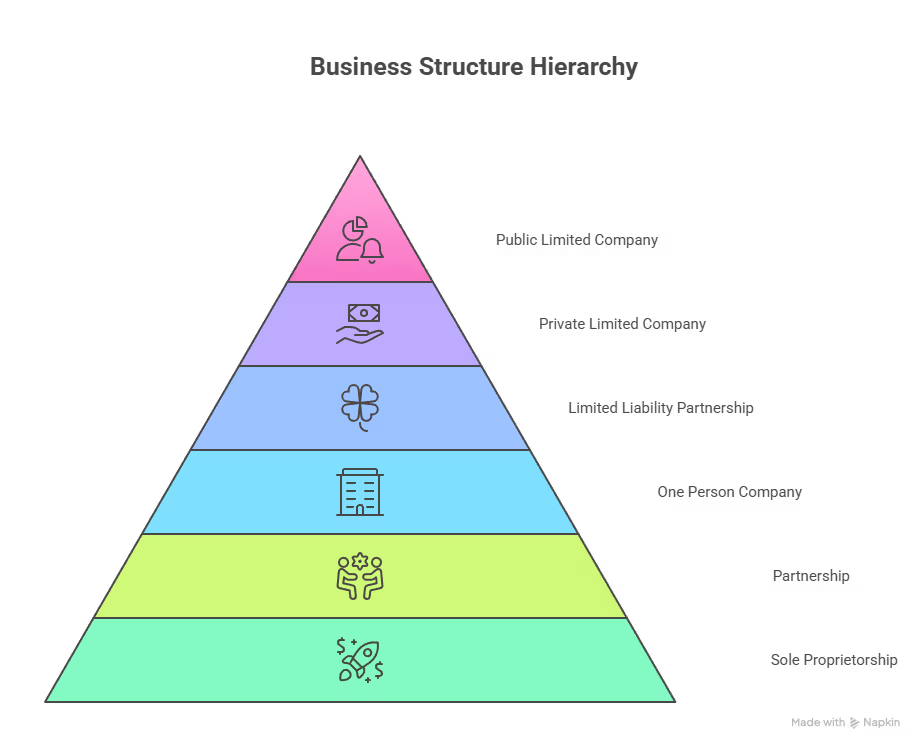

Compare Common Structures

Selecting the right structure depends on factors like the number of founders, growth plans, risk tolerance, and your need for credibility. Here’s a clear snapshot to help you decide:

| Structure | Pros | Cons | Best For |

|---|---|---|---|

| Sole Proprietorship | Easiest to start, little paperwork, direct control | No limited liability, hard to raise capital | Solo founders, home businesses |

| Partnership | Shared responsibility, flexible, low cost | Unlimited liability, potential disputes | Small teams, family businesses |

| One Person Company (OPC) | Limited liability, single owner, simple compliance | Cannot raise equity, only one member | Solo entrepreneurs seeking limited liability |

| Limited Liability Partnership (LLP) | Limited liability, flexible, easy to add partners | Compliance costs, public data | Professionals, service businesses |

| Private Limited Company | Protection for personal assets, easy funding, higher credibility | Complex setup, regular filings | Startups, scale-focused teams |

| Public Limited Company | Can raise money publicly, higher growth | High regulation, greater disclosure | Large growth-focused businesses |

If you plan to run things by yourself, a Sole Proprietorship or OPC will keep things simple. For joint ownership, compare the legal protection and flexibility between Partnership and LLP or Private Limited Company. LLCs and Private Limited are stronger for those who plan to raise outside funding or scale fast.

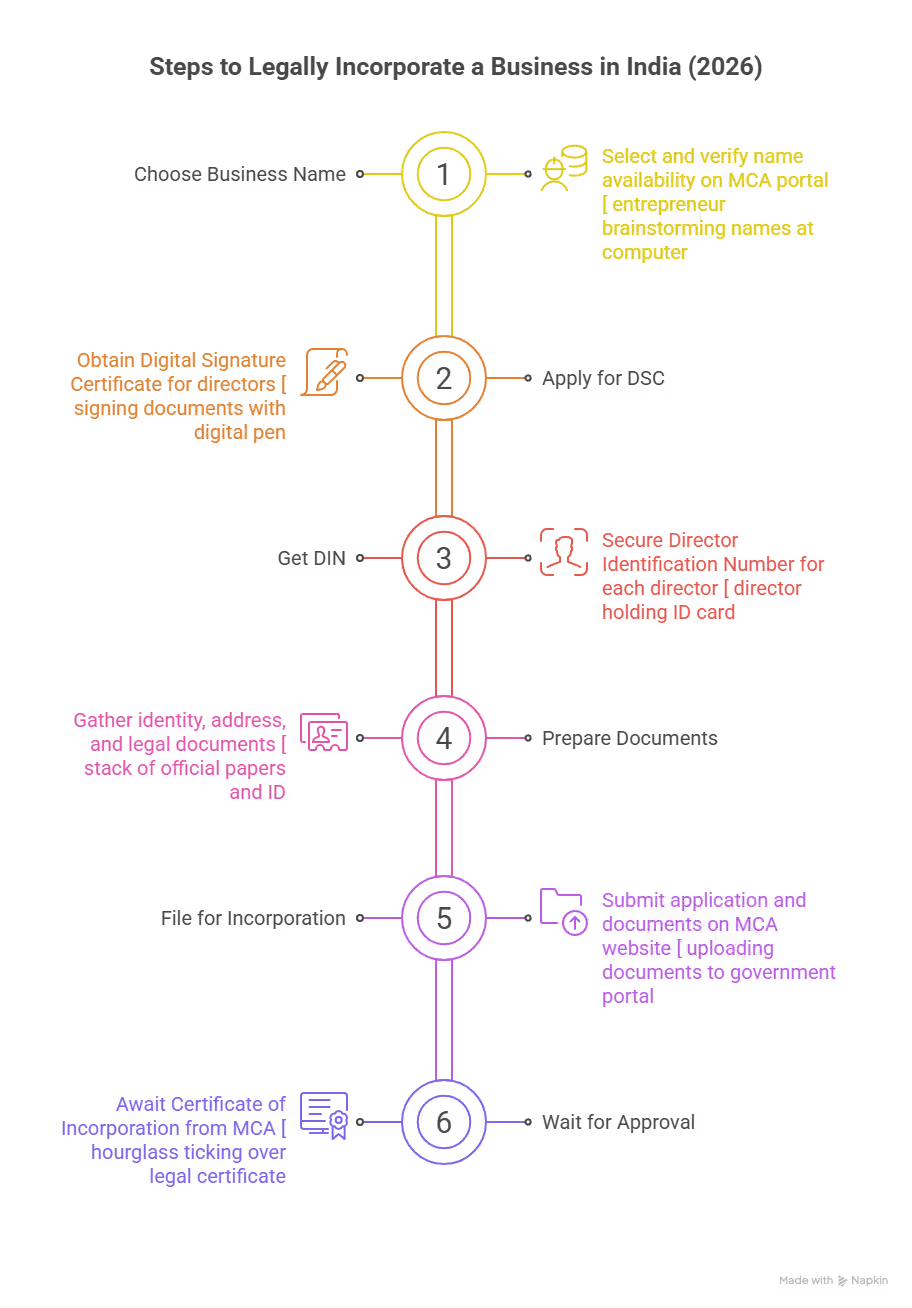

Register with MCA and Obtain DIN/DSC

Registration is the gateway to making your business official. For most formal entities (LLP, OPC, or Private Limited), you must register with the Ministry of Corporate Affairs (MCA). The process is now online, making it easier and quicker than a decade ago.

Here are the essential steps:

- Choose your business name and check availability on the MCA portal.

- Apply for a Digital Signature Certificate (DSC) for proposed directors. This lets you securely sign documents online (details on DSC registration are shown in this official step-by-step MCA guide).

- Get a Director Identification Number (DIN). Each director will need one. You’ll fill Form DIR-3 and submit identity proof—directions are in this complete DIN application guide.

- Prepare your documents: identity and address proof, utility bills, office address, and articles of association.

- File for incorporation through the MCA website—follow the form instructions, upload certificates, and pay the registration fee.

- Wait for approval. Once processed, you’ll receive a Certificate of Incorporation and your business is now legal.

These steps share similarities with the process for specific sectors, such as if you plan to start a gaming company in India, so you can use sector-focused guides for even more detail.

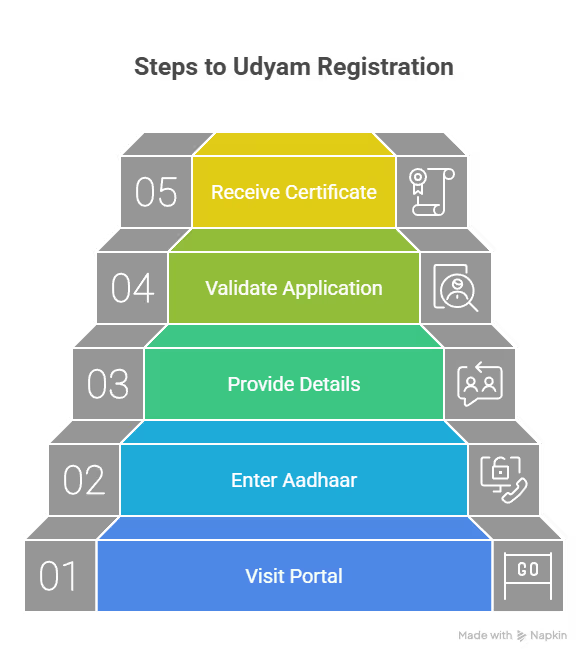

Udyam Registration for MSME Benefits

If you want to grow faster and take advantage of government support, registering on the Udyam portal is a smart move. Udyam Registration gives your micro, small, or medium-sized enterprise visibility and access to key benefits.

To complete Udyam Registration, follow these main steps:

- Visit the official Udyam Registration portal.

- Enter your Aadhaar number (for proprietors/partners/directors).

- Provide business details: name, type, PAN number, bank details, and investment numbers.

- Validate the application and submit the online form.

- Receive your Udyam Registration Number and certificate, often within hours.

You’ll need these documents:

- Aadhaar card of owner/partner/director

- PAN of business and/or owner

- Bank account info

- Business address details

Why get Udyam registration? It unlocks a long list of MSME benefits:

- Subsidized bank loans and interest rate reductions

- Faster loan approvals with less collateral

- Priority in government tenders

- Protection against delayed payments

- Subsidies on ISO certification and tech upgrades

- Access to exclusive state and central government schemes

This empowers you to secure funding and scale with less risk, a key reason why most new small businesses make Udyam Registration a priority when planning how to start a small business in India in 2026.

Linking your structural choice with proper registration is a practice followed by smart founders in every industry. If you want more guidance on preparing for this step, the how to write a business plan guide covers how to document your structure, role, and registrations in your plan.

Cost & Time Estimates for Starting a Small Business in India (2026)

| Step | Estimated Cost | Time Required |

|---|---|---|

| Research & Planning | Free – ₹5,000 | 2–4 weeks |

| Legal Structure & MCA Registration | ₹2,000 – ₹15,000 | 10–15 days |

| Udyam Registration | Free | 1–2 days |

| PAN, TAN, GST | ₹200 – ₹2,000 | 7–15 days |

| Sector Licenses | ₹1,000 – ₹10,000+ | 7–30 days |

| Business Bank Account | ₹0 – ₹10,000 deposit | 2–5 days |

| Funding Process | Minimal (processing fees 0.25–1%) | 15–45 days |

| Website & Hosting | ₹2,500 – ₹10,000 | 1–2 weeks |

| Marketing Setup | Free – ₹5,000+/month | 1–2 weeks (ongoing) |

| Launch & Scale | ₹5,000 – ₹20,000+ | 1–2 months (ongoing) |

Complete Registrations and Licenses

Registering your business is one of the most important steps when launching in India. These rules and requirements help prove your business is real and legal. Finishing these steps early will help you avoid future problems with banks, lenders, and even customers. Below is a quick and clear walkthrough of major registrations and the licenses you’ll need. This will keep your business on the right side of the law and ready for growth in 2026.

PAN, TAN, and GST Registration

You will need three main registrations for your business finances and taxes: PAN, TAN, and GST.

PAN (Permanent Account Number) Registration

- This 10-digit number is issued by the Income Tax Department.

- Every business must apply for a PAN, even if you are a sole proprietor.

- You’ll use the business PAN for filing taxes and for almost all business dealings, including opening a bank account.

- Applying is simple: submit your registration online through the NSDL portal or directly at designated centers. You need identity, address, and business documents. Most businesses get their PAN within two weeks.

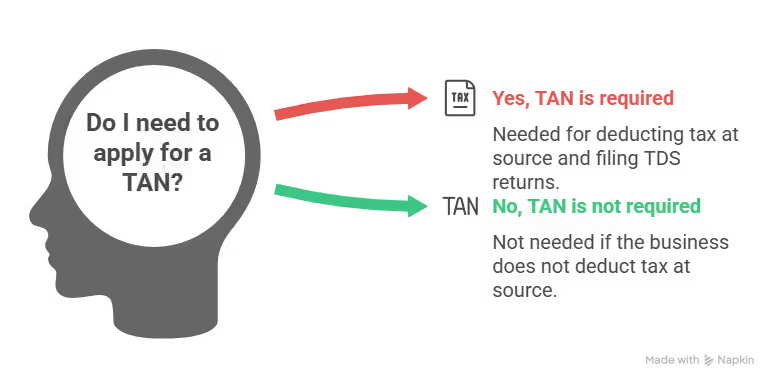

TAN (Tax Deduction and Collection Account Number) Registration

- TAN is needed if your business will deduct tax at source (TDS) on salary, vendor payments, or other situations.

- Apply for TAN online via the TIN-NSDL.

- A TAN is required for filing TDS returns and for payments where tax must be collected or deducted.

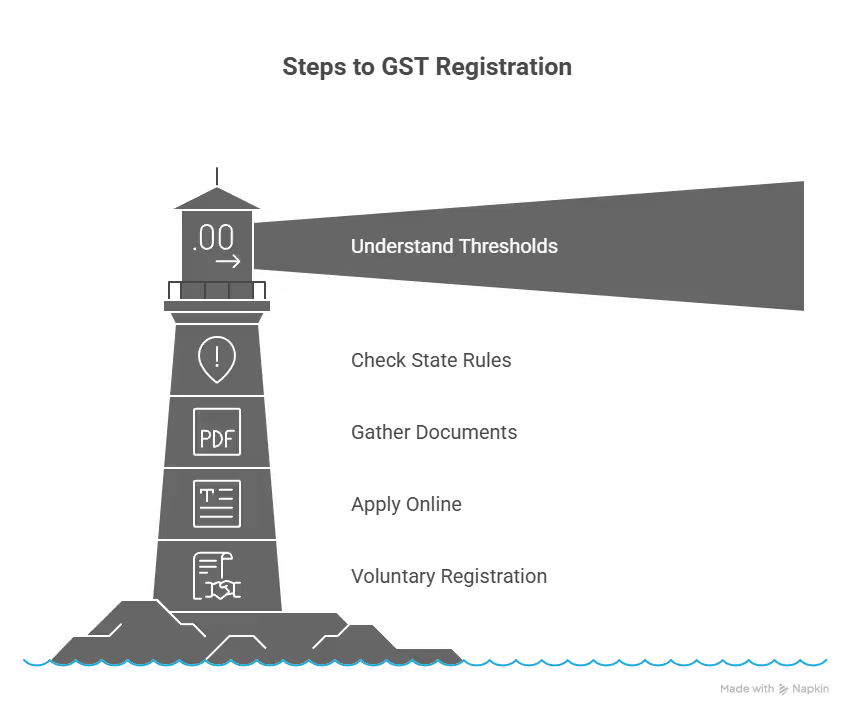

GST (Goods and Services Tax) Registration

- GST is mandatory for businesses that cross a specific yearly turnover threshold.

- As of 2026, the GST registration threshold limits have not changed since 2025:

- For businesses dealing in goods: Rs. 40 lakhs annual turnover.

- For businesses dealing in services: Rs. 20 lakhs annual turnover.

- In certain “special category” states, the threshold remains lower, so check for your state.

- If your turnover is below these limits but you want to sell online or claim input tax credit, voluntary registration is available.

- Apply for GST registration through the GST portal. Have your PAN, business address, bank details, MOA/AOA (for companies), and IDs ready.

- Get more details on current GST Registration Threshold Limits and minimum turnover rules.

Completing these registrations sets your business up for clear accounting and regulatory compliance. It builds trust with suppliers, customers, and funding partners.

Sector‑Specific Licenses

Many businesses in India need more than just tax registrations. The specific licenses depend on your industry and what you plan to sell or provide.

The most common licenses include:

- Shops and Establishment License

- Required for any business with a physical location, such as an office, store, or warehouse.

- Register with your state’s labor department, usually online. This license sets your working hours, employee rules, and holidays.

- FSSAI License (Food Safety and Standards Authority of India)

- Needed for any business handling food—restaurants, cafes, packaged food, online kitchens, or catering.

- Apply on the FSSAI website with basic health and safety details. There are three levels (Basic, State, Central) based on turnover and size.

- Import Export Code (IEC)

- Mandatory if you plan to import or export goods or services.

- Obtain your IEC from the DGFT portal using your PAN, address, and bank documents.

- The process is digital and usually completed in a few days.

- Local Trade Licenses and Permits

- Many municipal authorities require trade licenses for local businesses. These cover fire safety, pollution control, signage, and other rules.

- Check with your city municipal corporation for requirements and apply accordingly.

Getting the right sector licenses protects your business from shutdowns or penalties. It also opens new doors: for example, FSSAI licensing is a must for selling through platforms like Zomato or Swiggy.

Open a Dedicated Business Bank Account

Opening a separate bank account for your business is simple but essential. It keeps your business money apart from your personal funds, which is important for clear accounting and financial health.

Why this matters:

- Easy bookkeeping: All incoming and outgoing business payments happen in one place, making it easy to track income, expenses, and profits.

- Tax filing: You need clean records for accurate and simple tax returns. The bank statement acts as your financial log for GST, income tax, and audits.

- Professional image: Suppliers, customers, and lenders trust you more when payments and receipts go to a business account with your brand name.

- Loan eligibility: Most loans and POS services for businesses require proof of business banking. Lenders will look at your business bank statements for credit decisions.

- Owner protection: Mixing personal and business money causes confusion, tax errors, and even potential legal trouble.

To open a business account, you’ll need:

- Your business’s PAN

- Certificate of registration or incorporation

- Partnership or incorporation deed (for partnerships/companies)

- Address proof and identity documents of proprietors or directors

This step is not just a formality. A dedicated business account is a real tool for organizing your business, which will set you up for growth and better funding options in the future.

Getting these registrations and licenses early is a simple but powerful way to boost your business’s credibility. These requirements may seem detailed, but they protect your business and make it easier to get help and support as you grow. For a full step-by-step breakdown of the early-stage registrations for MSMEs and startups, see the resource on how to register your business in India.

Secure Funding and Financial Planning

Organized funding is the backbone of any new business. In 2026, Indian founders have more ways to finance their startups than ever before. Smart planning and the right funding mix can make the difference between slow growth and real momentum. Below are the main sources of funding for anyone learning how to start a small business in India in 2026. Each path comes with its own pros, tips, and steps so you can match your funding to your business goals.

Bootstrapping and Personal Savings

Bootstrapping means starting your business using your own savings or resources. It keeps things simple—no banks or outside investors, and you remain in total control.

How to get it right:

- Start with a clear list of your available funds. Set a strict initial budget.

- Keep a personal record of every business expense, from website fees to inventory.

- Use digital tools or a basic accounting app to track cash flow daily.

- Avoid spending on anything you cannot justify in your business plan.

Benefits:

- You keep 100% of the ownership and decision-making power.

- No pressure from lenders or investors.

- Funding is always available since it’s your own, but you need to be strict with every rupee.

Risks:

- You may run out of cash if not careful.

- Growth may be slow if your savings are limited.

To keep your business on solid financial ground, monitor cash flow closely and update your budget monthly. Simple habits like separating personal and business expenses and paying yourself a fixed salary from the start create professional discipline. If you’re unsure how to assess your true funding needs or cash flow, check out a guide to financial feasibility analysis for projects to stay on track.

Government Funding Schemes

India’s push for entrepreneurship comes with many government-backed funding options in 2026. These schemes reduce risk, encourage first-time founders, and can be the launchpad for new ideas.

Here are key programs and their main points:

| Scheme | Loan/Grant Amount | Who Can Apply | Key Requirements | Where to Apply |

|---|---|---|---|---|

| PMMY (Mudra Yojana) | Up to ₹10 lakh | Small businesses; non-corporate | Business plan; KYC docs | Any Indian bank, NBFC |

| Stand-Up India | ₹10 lakh–₹1 crore | Women, SC/ST entrepreneurs | Greenfield enterprise; age 18+ | Stand-Up India official page |

| PMEGP | ₹10 lakh–₹25 lakh | Any new micro/SME | Age 18+, new unit, project report | Learn more about PMEGP |

| Startup India Seed Fund | Up to ₹20–50 lakh | Early-stage, DPIIT-recognized startups | Less than 2 yrs old; innovative idea | Startup India Seed Fund Scheme |

Tips for applying:

- Prepare a detailed and realistic project report.

- Gather all required documents in advance (ID, address proof, business plan, existing business financials, if any).

- Choose the right scheme and review all eligibility terms first.

- Visit the official government schemes page for startups to check for updates before you apply.

- Most programs need you to register your company and may require Udyam or Startup India recognition.

With each scheme, lenders want to see that you understand your business and its earning potential. Take time to research, complete paperwork carefully, and follow up regularly after submission for best results.

Private Capital Options

Not all startups fit government programs. Growth-focused businesses often turn to private investors or online platforms to raise money and add experience to their team.

Angel investors are individuals who invest early in startups in exchange for equity. They often bring industry knowledge and networks. Major Indian angel groups include Indian Angel Network and Mumbai Angels.

Venture capital funds pool larger sums to back startups with high growth plans and a proven business model. They look for big market potential and a strong founding team.

Crowdfunding lets you raise small amounts from many individual supporters, usually online. Sites like Kickstarter and Milaap are active in India and work well for creative, tech, or impact-driven projects.

Common steps to get private capital:

- Craft a clear, short pitch that describes your idea, potential market, revenue plans, and why you’re different.

- Prepare a realistic, data-driven business plan and financial forecast.

- Research potential investors to target those interested in your industry or region.

- Use a platform that fits your business type, whether it’s early-stage, social-impact, or consumer-focused.

Private funding can move quickly but often requires giving up some ownership. For early-stage founders who want guidance and funds, see this explainer on seed capital assistance for startups and how to make your first approach count.

No matter which path you choose, careful planning, solid records, and active networking will help you get funded and keep your business healthy as you learn how to start a small business in India in 2026.

Build Your Online Presence and Marketing

Getting your business online is now a key part of how to start a small business in India in 2026. People check businesses online before making any decisions. A strong internet presence not only helps you attract more customers but also builds trust and makes your company look professional. Effective marketing connects you with your audience and fuels growth—sometimes even more than your location or product.

Below is a clear guide to start and grow your digital presence, no matter your skill or budget.

Create a Professional Website

A website is your business’s main address on the internet. Without one, you risk losing customers to competitors who look more established. You don’t have to hire expensive designers. Affordable website builders like Wix, WordPress, and Shopify are easy to use and do not require technical skills.

Essential pages every small business website should have:

- Home: Brief summary of your business and what you offer.

- About Us: Your story, mission, and values.

- Products/Services: Detailed information on what you sell or provide, with photos and prices.

- Contact: Phone, email, address, and a simple inquiry form.

- FAQ: Answers to common questions to help visitors quickly.

- Testimonials or Reviews: Builds trust with new visitors.

For best results, start simple and only add more features as you grow. Keep your page layout clean—easy navigation and short paragraphs make your site more engaging.

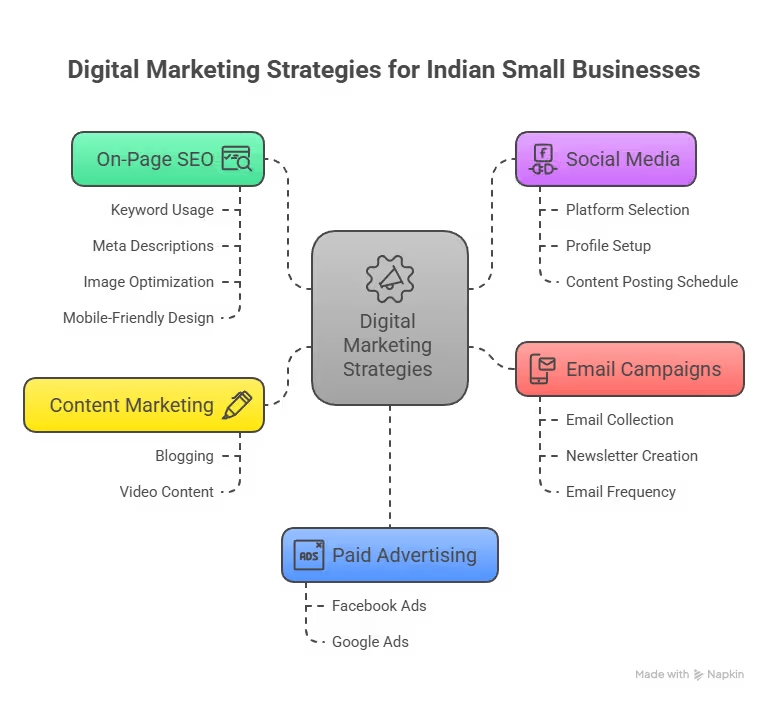

On‑Page SEO basics to boost your website’s visibility:

- Use your main business keywords (like “furniture store Delhi” or “organic soap Jaipur”) in your titles, headings, and product descriptions.

- Add meta descriptions for each page using clear sentences about the page’s content.

- Label your images with descriptive file names and alt text.

- Make sure your website is fast and mobile‑friendly.

Applying basic search engine optimization, even if you’re new to it, helps your website show up higher in Google searches. You can learn more about strategies tailored for Indian markets in this digital marketing guide for small businesses.

Leverage Social Media and Content Marketing

Social media can turn a new business into a popular brand. The right channels let you speak to your customers without high costs. For Indian startups, Facebook, Instagram, and WhatsApp remain powerful. LinkedIn works well if you sell services or target other companies.

Before you start, pick the platforms that fit your target audience. For example:

- Instagram is good for visual businesses (fashion, food, decor).

- Facebook suits local shops or service providers.

- YouTube and short video platforms are great for how-to content and product demos.

Tips for setting up your social profiles and content marketing:

- Use the same logo, business name, and contact info on all platforms.

- Write a clear bio describing what you do in one sentence.

- Post high-quality images or videos of your products, behind-the-scenes updates, and customer success stories.

A simple posting schedule works best. Aim for:

- 3–4 posts per week on Facebook and Instagram.

- 1–2 videos weekly if you use YouTube or similar platforms.

- Answer direct messages and comments daily for better engagement.

Blogging is a top way to drive traffic to your website. Share short, useful tips or stories related to your field. Video is another strong tool. Short tutorials, Q&As, or demos attract more attention, especially when shared on social media. Looking for more ways to earn online in 2025? These online income ideas for 2025 give inspiration for digital business growth.

For even more tips to connect with your audience, see this list of digital marketing trends in India for 2026, covering what’s actually working for small businesses.

Intro to Paid Advertising and Email Campaigns

Paid ads and email offer low-cost, high-impact marketing methods. You don’t need a big budget to see results.

Affordable paid advertising options:

- Facebook and Instagram Ads: Even ₹100 per day can get your brand seen by hundreds of local customers. Set your own budget, target by interests and location, and see fast results.

- Google Ads: Perfect for local businesses who want to show up first when people search for things like “best cake shop in Mumbai.”

Create simple ad creatives: a clear photo, direct headline, and a call-to-action like “Call Now” or “Shop Today” works best.

Getting started with email campaigns:

- Collect email addresses from your website, social pages, or in-person at your shop.

- Use tools like Mailchimp or Zoho Campaigns for free to send regular newsletters.

- Share updates, promotions, blog posts, and helpful announcements—not only sales messages.

Send emails 2–4 times a month. Make every email helpful and relevant. Include links to your best content or latest offers. Email is a personal channel that builds lasting relationships.

If you want more inspiration on recurring online income and proven internet models, check out these standout recurring revenue ideas for digital-first brands.

Building your online presence with a website, smart use of social media, and simple digital marketing methods will give your business a strong foothold and help you stand out as you learn how to start a small business in India in 2026.

Launch, Operate, and Scale Your Business

Starting a business is just the beginning. The steps you take after going live set the tone for your growth and reputation. Companies that launch carefully, listen to customers, and adjust quickly will see stronger results. To stay ahead in India’s active 2026 market, you need to operate well and be ready to scale when opportunities arise. Let’s look at how to start with a soft launch, maintain top service, and set up your business to expand.

Soft Launch and Customer Feedback

A soft launch means releasing your business or product to a small group before going public. This is a smart move for anyone searching for answers on how to start a small business in India in 2026. A limited release lets you test your offer with real customers, fix bugs, and earn early reviews.

Tips for a smooth soft launch:

- Select a small but diverse group of customers, such as friends, past clients, or new users from your target market.

- Keep your product or service simple at first. Launch with your core features, not the full range.

- Clearly explain to early users that their feedback will help you improve. People feel valued when they know their input matters.

Collecting reviews is key. You can offer a discount, freebie, or loyalty points for honest feedback. Listen to what works and what doesn’t. Use tools like Google Forms, WhatsApp surveys, or quick polls. Document all feedback so you can spot trends or repeat issues.

Quick iteration is your best friend here. Fix the top pain points fast and thank users for their suggestions. This helps build goodwill and improves your product—even before your big launch.

For more business ideas and detailed small business tips, visit 80 top small business ideas to start in 2025.

Maintain Quality Service and Iterate

Keeping customers happy is the backbone of long-term success. Positive word of mouth and loyalty drive steady growth. Customer support should be fast, polite, and focused on solving problems.

How to maintain quality and use feedback:

- Offer multiple channels for customer support. Phone, email, WhatsApp, or social media help reach more people.

- Set a clear standard for response times and stick to it.

- Track each support case and learn what concerns are most common.

- Respond to feedback, good or bad, with a positive attitude. Make fixes when possible and explain why you made changes.

Iterating means updating your product, processes, or service based on what you learn. Make small but regular improvements. These can be new features, easier navigation, or changes in your delivery process.

Track key performance indicators (KPIs) such as:

- Customer satisfaction score (CSAT)

- Repeat purchase rate

- Average resolution time

- Churn or cancellation rates

These numbers let you spot problems early and see if changes are working. Reliable tracking helps keep your operations strong, supports future fundraising, and makes scaling more predictable.

If you want a list of steps from idea to launch, check out this summary on how to start a small business in India.

Scaling Strategies

If your systems run smoothly and you see solid demand, think about scaling up. Scaling means growing your operations without losing quality.

Here are proven strategies for scaling a small business in India:

- Hiring Staff: Start by filling the roles that give you the most time back or boost sales. Hire carefully and train for both skills and attitude.

- Expanding into New Cities: Study your market with local research. Consider distribution partnerships or opening small offices in growing regions.

- Exploring Additional Products or Services: Listen for customer requests or unmet needs. Test new offers with limited releases before a wide rollout.

Smart scaling is methodical. Don’t rush. Tune your supply chain, update your processes, and invest in staff training. Track your numbers before and after big changes to measure real results.

Want more growth tips and expansion steps? See the advice in How to Expand My Small Scale Business in India.

Learning how to start a small business in India in 2026 is not just about getting started. It’s about growing in smart stages, based on customer feedback, reliable operations, and a mindset ready for change.

Photo by RDNE Stock project

Conclusion

Starting a small business in India in 2026 is easier, faster, and more promising than ever. Every step matters—from research to registration, financial planning, going online, and growing your team. With government programs, digital tools, and a wide range of business structures, you can turn ideas into profits and build something lasting.

The path is clear: research your business idea, create a simple plan, choose the right structure, finish all registrations, open a business bank account, and secure funding that fits your goals. Build a strong online presence and focus on quality in both product and service. Listen to feedback and improve as you go.

India’s business environment is opening doors for new entrepreneurs. Now is the time to act. Take the step to register your business, claim your spot in the market, and join millions already finding success. For a step-by-step checklist or detailed guides on specific registrations, you can explore topics like MSME and financial feasibility analysis for projects.

Thank you for reading. If you have your own ideas or challenges about how to start a small business in India in 2026, share your thoughts below. Your business journey starts with a single step—why not start today?

Leave a Review