The micro, small, and medium enterprises (MSME) sector is the backbone of many developing economies, driving innovation, employment, and economic growth. In India, registering SSI (Small Scale Industries) is of particular importance, not only for availing the numerous benefits the government offers but also in establishing prominence in an increasingly competitive market.

Entrepreneurs in the Indian business landscape are involved in varied endeavors, from traditional family businesses to cutting-edge startups. However, navigating the registration process can be daunting, especially when seeking the most relevant and up-to-date information.

In this extensive blog post, we cover the Registration of SSI, focusing on the critical Udyog Aadhaar Memorandum (UAM). We also provide a comprehensive guide on the application process for the Udyog Aadhaar portal, ensuring that you, as a small business owner, understand the steps needed to secure your MSME certificate.

Registration of SSI

According to the MSME Act of 2006, all enterprises must register with their District Industries Centre (DIC). Entrepreneurs must file EM 1 to declare their intention to start a business in manufacturing or services. After starting production, they should file EM 2.

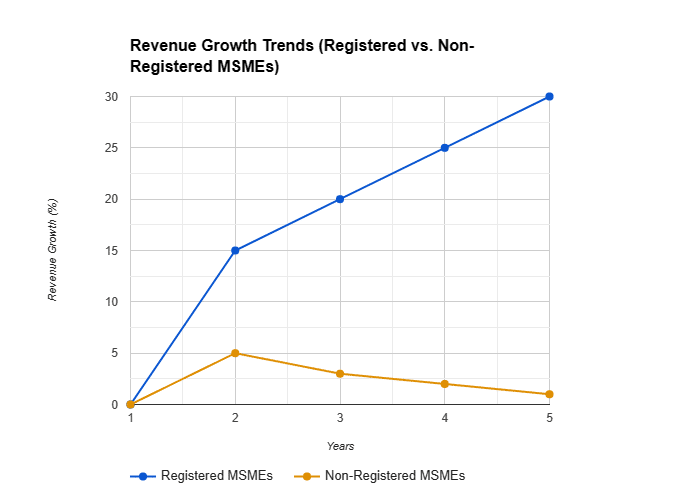

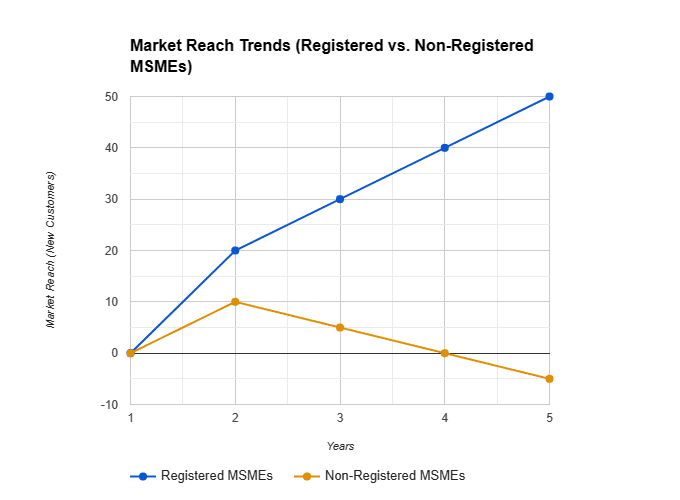

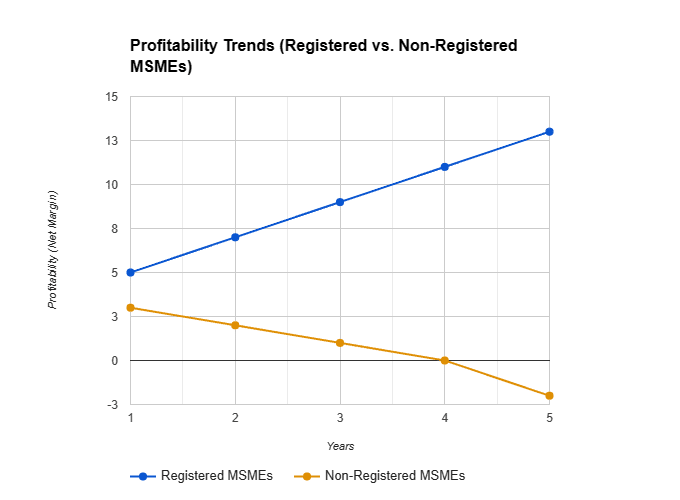

A large chunk of enterprises in India are simply not registered due to a lot of paperwork involved in the process. Therefore, they can’t utilize the government schemes for them.

In September 2015, the Ministry for Micro, Small, and Medium Enterprises introduced Udyog Aadhaar for easy registration and wider coverage of MSME schemes and government schemes.

Udyog Aadhaar is a single window clearance system recommended by the Kamath Committee on the Financial Structure of the MSME sector. This policy streamlines the registration process for MSMEs. As a result, the filing of EM-I has been abolished, and Udyog Aadhaar is now the preferred method for registering running units.

Hence, at present, the filing of EM-I has been abolished. Udyog Aadhaar (UA) has been introduced for running unitsUdyog Aadhaar (UA) is a registration scheme introduced for small and medium-sized enterprises. It aims to provide various benefits and incentives to help these businesses thrive.

If you have a running unit, getting registered under the UA scheme can be beneficial for you. There is no need to apply for upcoming units. You can fill out the Udyog Aadhaar Memorandum (UAM) online on the Ministry of MSME portal.

Udyog Aadhaar Memorandum (UAM)

Small and medium-sized industries can start any business, but they must be registered as MSMEs. Registration as MSME can be done online or offline, giving businesses flexibility in the process. This facility is called Udyog Aadhar. The reason for launching this Aadhar is to provide maximum benefits to the small and medium-scale industries, that are registered with MSME through this Aadhar number.

Those industries who are registered with Udyog Aadhar will be getting the benefits of all Government schemes like easy loans, subsidies, etc.

UAM is a simple one-page registration form for MSMEs to self-declare their existence, bank account details, and Aadhaar information

There shall be no fee for filing the Udyog Aadhaar Memorandum. To do the registration he/she has to fill a single form which is available on the website. Once submitted, a Udyog Aadhaar Acknowledgement will be emailed containing a unique Udyog Aadhaar Number (UAN).

The registration number is a 12-digit number. Enterprises that have filed Entrepreneurship Memorandum-l or Entrepreneurship Memorandum-ll, or have Small Scale Industry registration before the Micro, Small and Medium Enterprises Development Act, 2006 came into force, do not need to file Udyog Aadhaar Memorandum. However, they can choose to file the Udyog Aadhaar Memorandum if they wish to.

You can file multiple Udyog Aadhaar Memorandums using the same Aadhaar Number without any restrictions. The Udyog Aadhaar Memorandum is filed on a self-declaration basis, and no supporting document is required to be uploaded or submitted while filing the Udyog Aadhaar Memorandum.

But the Central Government or the State Government or such person as may be authorized on this behalf may seek documentary proof of information provided in the Udyog Aadhaar Memorandum, wherever necessary.

Udyog Aadhar provides a 12-digit unique ID for your company, making it a legal entity.

Instructions for Filling the Online Udyog Aadhaar Form

To start a business as a micro, small, or medium enterprise, getting registered under Udyog Aadhar is necessary. The enterprise owner can easily register by filling out a form on the ministry’s website. The application form is free and available online or offline. Here is the application form for registration:

| Field Name | Description | Notes |

|---|---|---|

| Aadhaar Number | Enter the 12-digit Aadhaar number. | Must match the applicant’s Aadhaar card. |

| Name of Applicant | Enter the applicant’s name exactly as on Aadhaar card. | |

| Social Category | Select the applicant’s social category. | |

| Gender | Select the applicant’s gender. | |

| Physically Handicapped | Indicate if the applicant is physically handicapped. | |

| Name of Enterprise / Business | Enter the business name for the MSME certificate. | |

| Type of Organization | Choose the type of organization for the MSME certificate. | Examples: Proprietorship, Partnership, etc. |

| PAN | Enter the 10-digit PAN number (if applicable). | Required for LLP, Co-operative Society, Pvt Ltd, Public Ltd. |

| Location | Enter the accurate location of the plant. | |

| Office Address | Provide the office address (if different from plant location). | Optional |

| Mobile No | Enter the applicant’s correct mobile number. | |

| Mail ID | Enter the applicant’s correct email address. | |

| Date of Commencement of Business | Enter the accurate date business commenced. | |

| Bank Account Number | Enter the applicant’s bank account number. | |

| Bank IFS Code | Enter the bank’s IFS code (from cheque book). | |

| Main Business Activity | Select the main business activity from the options. | |

| NIC 2 Digit Code | Choose the 2-digit NIC code related to your business activity. | National Industrial Classification Code |

| Additional details about Business | Add any additional details about the business (optional). | |

| Number of employees | Provide the total number of employees. | |

| Investment in Plant & Machinery / Equipment | Enter the total investment in starting the business.pen_spark |

The documents required for the Udyog Registration Certificate are

- Aadhar number

- Industry name

- Address

- Bank account number

- PAN number in case of Co-operatives, Private or Public Ltd and LLP

- Other details of major activity carried out by the enterprise.

Benefits Of Having MSME / SSI Registration Certificate (Benefits of Registration under Udyog Aadhar System)

With the introduction of Udyog Aadhar, the registration process is simplified. The following are the benefits of registration under Udyog Aadhar:

- Easy sanction of bank loans at lower rates of interest.

- Getting licenses, approvals, and registrations is very easy

- Special consideration on international trade fairs

- Octroi benefits:

- Waiver of Stamp Duty and Registration Fees:

- Exemption under Direct Tax Laws:

- Bar Code registration subsidy:

- Counter Guarantee from the Government of India through CGSTI

- Protection against delay in payment

- Waiver in Security Deposit in Government

- Concession in electricity bills:

- Reimbursement of ISO Certification

- Excise Exemption

15% of the price will be given as weightage in preference. Additionally, there will be a 1% exemption on the interest rate for overdrafts. Moreover, a 50% subsidy will be provided for patent registration.

Limitations

- Eligibility Criteria: Some businesses might find the eligibility criteria too restrictive, sidelining ventures that could benefit from SSI registration but do not fit the stringent definitions.

- Complexity in Documentation: The requirement for extensive documentation can be daunting for some, especially those in rural or semi-urban areas with limited access to resources.

- Delayed Processing Time: Although digital interventions have streamlined processes, some applicants still experience delays in registration approval, which can impede business operations.

- Insufficient Awareness: There’s a gap in awareness about the benefits of registration and how to navigate the process, which leads to lower uptake among eligible enterprises.

- Limitations on Benefits: Certain benefits tied to SSI registration may not be as advantageous or accessible for all registered businesses, depending on the sector and scale.

- Renewal and Updation Challenges: Keeping the UAM updated and renewing registration can prove cumbersome for some enterprises, affecting the continuity of benefits.

- Bureaucratic Red Tape: Despite efforts to reduce bureaucratic hurdles, some businesses still face red tape in availing the intended benefits, or in dealing with governmental departments post-registration.

My experience with registering for Small Scale Industries (SSI) units has been both eye-opening and tough. At first, signing up for the Udyog Aadhaar Memorandum (UAM) seemed scary because of how detailed each step was.

But, after I got together all the needed paperwork, like business details, bank info, and putting my business in the right category based on the National Industrial Classification (NIC) code, things started to get easier.

The biggest issue I ran into was figuring out what specific things my type of business needed to do, as it changed based on what my business was about. However, getting help from other small business owners who had been through it before made the process smoother.

The best part was seeing how getting the SSI registration helped right away. It didn’t just open up access to government help and money-saving deals, but it also made my business look more trustworthy to potential customers and partners.

Getting through the Udyog Aadhaar steps taught me that being persistent and paying close attention to details pays off. Even though it might seem complicated at first, the perks of having an SSI registration are worth the effort.

Conclusion

SSI registration is more than a statutory obligation; it is a key to unlocking the latent potential of small-scale enterprises. By demystifying the process, elucidating the benefits, and drawing on real-life accounts, this blog post paints a comprehensive picture of how strategic SSI registration can be a game-changer for your business.

It’s time to take the plunge, to register not just your business but your ambition, potential, and dreams. The voyage may be arduous, but the destination is nothing short of spectacular—a thriving, credible, and globally competitive enterprise standing tall among its peers.

Frequently Asked Questions (FAQ)

What is Udyog Aadhaar?

Udyog Aadhaar is a 12-digit unique identification number issued by the Ministry of Micro, Small and Medium Enterprises (MSME), Government of India, for small and medium enterprises (SMEs). It’s meant to simplify the regulatory process for small businesses by providing them with a single registration certificate.

Who is eligible for Udyog Aadhar registration?

Any micro, small, or medium enterprise (as defined by the MSME Act) operating within India is eligible for Udyog Aadhar registration. This includes manufacturing and service sector businesses.

What are the documents required for Udyog Aadhar registration?

The primary documents required include the Aadhar number of the business owner, PAN card (for cooperatives, private or public limited, and LLPs), bank account details related to the business, and other relevant business details such as NIC code, employee details, and investment information.

How long does it take to obtain Udyog Aadhar registration?

The processing time for Udyog Aadhar registration can vary but it’s typically completed within a few days after submission of all necessary documents and information.

Is there any cost associated with Udyog Aadhar registration?

No, the Udyog Aadhar registration process is entirely free of charge.

Can I update my Udyog Aadhar details after registration?

Yes, updates to your Udyog Aadhar details can be made online through the Udyog Aadhar portal. It’s important to keep your registration details current to ensure you continue to be eligible for the various benefits.

What benefits can I expect from having a Udyog Aadhar registration?

Benefits include eligibility for lower rates on bank loans, easier approval of licenses and registrations, subsidies for participating in international trade fairs, various exemptions, and support in government tenders, among others.

Is Udyog Aadhar registration mandatory for MSMEs?

While it’s not mandatory, registering provides substantial benefits and access to support and subsidies offered by the government for MSMEs. It’s highly recommended for businesses that qualify.

Leave a Review